Anti-fraud

Anti-fraud Tips

-

Six Tips to Prevent Fraud

-

- Be vigilant: Think twice before providing any personal data, verify the purpose of collection of such data and whether it is mandatory to provide them. Do not disclose personal data to others arbitrarily, avoid clicking or scanning suspicious links and QR codes, and do not log into any suspicious websites;

- Authenticate the identity of callers: Even if the caller makes a video call or can provide your personal data, if you are in doubt about their identity, you should verify the authenticity of the caller or relevant organisations through other contact methods;

- Keep an eye on your accounts and transaction records: Regularly check online banking for any unusual log-in activities, unauthorised transfers or transactions in your bank accounts or credit cards;

- Password protection: Change the passwords of online banking accounts from time to time and enable two-factor authentication (if available). Never share passwords with anyone;

- Smart use of social media and instant messaging apps: Minimise the sharing of biometric data, such as portrait photos and videos, on social media platforms and instant messaging apps, and review the relevant default security and privacy settings; and

- Fraud prevention information: Pay attention to the fraud prevention information published by the PCPD, the Police or relevant organisations. Share the information with friends and relatives (especially the elderlies and youngsters) to enhance their awareness of fraud prevention.

-

-

Relevant Examples

-

-

Fraudulent Recruitment Advertisements Scams

- Fraudsters would take advantage of the victims’ desire to pursue work opportunities abroad or earn quick money by using fraudulent online recruitment advertisements to lure them into providing their personal data for engaging in unlawful activities. Some of them had even been lured to cities in Southeast Asia, where they were detained and forced to carry out fraudulent work.

-

Scams Using Instant Messaging Applications (Apps)

- The scammers hijacked the victims’ accounts and impersonated them to send messages to the contacts contained in their address books, aiming to swindle the victims out of money and/or personal data.

-

Scams by Counterfeit Customer Service Agents/Online Auction Platforms

- Fraudsters impersonated customer service agents of e-wallets or banks and fraudulently claimed that the victims’ insurance policies had expired and that monthly premiums needed to be paid. When the victims indicated that they did not have the relevant insurance policies, fraudsters would pretend to help them cancel the policy to avoid the deduction of premiums, and then enticed them to provide information on their bank accounts, the amount of money deposited, and their personal data. Finally, they would ask the victims to transfer all of their money to a designated account for “account unlocking”.

- Fraudsters first posed themselves as buyers on online auction platforms and claimed to have paid through the payment function of the relevant platforms. They then contacted the victims by email, posing as the platform, to solicit their personal data, online bank account names, passwords and one-time passwords, etc. in order to receive the payment, with a view to transferring the victims’ bank deposits.

-

SMS/Email Scams

- Fraudsters sent out phishing SMS, falsely claiming that victims’ reward points were about to expire under membership reward schemes. They induced the victims to click on the embedded hyperlinks, which led them to fraudulent websites to redeem rewards so that the fraudsters could obtain the victims’ credit card information and personal data.

- Fraudsters pretended to be government officials, government departments or public bodies and disseminated fake messages through instant messaging apps or fraudulent emails to deceive people for money and/or personal data.

-

Telephone Scams

- Fraudsters called victims in the form of pre-recorded voice messages (including Putonghua voice messages), falsely claiming that they were staff of courier companies or law enforcement officers from the Mainland and the victims were involved in criminal cases. They then forwarded the calls to other bogus Mainland law enforcement officers, who showed the victims forged wanted warrants. Fraudsters would then ask the victims to provide personal data (e.g. online banking usernames and passwords) or transfer money to designated bank accounts as guarantee money.

-

Scam Videos Using Artificial Intelligence (AI) Deepfake Technology

- Fraudsters manipulated public footages, used the photos or audio recordings of government officials or celebrities to produce videos using AI deepfake technology to deceive people into investing in fake investment schemes.

- Fraudsters obtained the biometric data of other people, such as their facial images and voice, through social media, video calls or online public footages, to create videos using deepfake technology and impersonated victims’ friends, relatives or colleagues, or pretended to be interested in developing a relationship with the victims, to swindle money and/or personal data.

-

Scams on Social Media Platforms

- Fraudsters created fake pages on social media platforms pretending to be selling Lunar New Year products, investment or travel agencies and advertised special offers, attracting victims to click on the hyperlinks to make enquiries in order to defraud them of their money and/or personal data.

-

Fraudulent Recruitment Advertisements Scams

-

-

Education Information

-

-

Presentation deck

- Seminar on “Protecting Personal Data to Prevent Fraud”

- Sharing Festive Joy with Smart Elders – Privacy Commissioner’s Office Volunteer Team Organises a Fraud Prevention Christmas Gathering for Around 200 Elders (Chinese version only)

- “Don’t Hand Over Your Personal Data – Beware of Fraudsters” — Christmas Talk for the Elderly Organised by the Privacy Commissioner’s Office Volunteer Team (Chinese version only)

-

Seminar on “Safe Use of WhatsApp and Social Media Platforms”

- Privacy Commissioner for Personal Data, Ms Ada CHUNG Lai-ling (Chinese version only)

- Director of Privacy and Data Policy, Engagement, APAC, Meta, Ms Raina YEUNG Sau-ling (Chinese version only)

- Be a Smart Elderly — New Year Talk for Elderlies Organised by the Privacy Commissioner’s Office Volunteer Team (Chinese version only)

-

Video – Generative Artificial Intelligence “Deepfake” Video (Chinese version only)

-

Video - Don't Hand Over Your Personal Data — Beware of Fraudsters (Romance Scam) (Chinese version only)

-

Video - Don't Hand Over Your Personal Data — Beware of Fraudsters (Healthcare Products Promotional Scam) (Highlight) (Chinese version only)

-

Video - Don't Hand Over Your Personal Data — Beware of Fraudsters (Healthcare Products Promotional Scam) (Chinese version only)

-

Video - Don't Hand Over Your Personal Data — Beware of Fraudsters (Promotional Gifts Scam) (Chinese version only)

-

Video - Don't Hand Over Your Personal Data — Beware of Fraudsters (Rewards Programmme Fraud) (Highlight) (Chinese version only)

-

Video - Don't Hand Over Your Personal Data — Beware of Fraudsters (Rewards Programmme Fraud) (Chinese version only)

-

Highlight Video - PCPD's Volunteer Team Organises a Fraud Prevention Christmas Gathering for the Elderly (Chinese version only)

-

Video - Scameter+ (Chinese version only)

-

Video - Seminar on “Beware of Scams Protect Your Personal Data”: Ms Joyce LAI, Assistant Privacy Commissioner for Personal Data (Corporate Communications and Compliance) (Chinese version only)

-

Video - Seminar on “Beware of Scams Protect Your Personal Data”: Mr Andy LAU, Senior Inspector of Police, ADCC (Publicity) of the Commercial Crime Bureau, Hong Kong Police Force (Chinese version only)

-

Video - Seminar on “Safe Use of WhatsApp and Social Media Platforms”: Ms Ada CHUNG Lai-ling, Privacy Commissioner for Personal Data (Chinese version only)

-

Video - Seminar on “Safe Use of WhatsApp and Social Media Platforms”: Ms Raina YEUNG, Director of Privacy and Data Policy, Engagement, APAC, Meta (Chinese version only)

-

Highlight Video - PCPD's Volunteer Team Organises a Christmas Talk for the Elderly (Chinese version only)

-

Highlight Video - PCPD's Volunteer Team Organises a New Year Talk for the Elderly (Chinese version only)

-

Poster - Too good to be true?

-

Poster - Privacy Commissioner Offers Six Tips to Prevent Fraud

-

Poster - Don't Hand Over Your Personal Data — Beware of Fraudsters

-

Poster (Chinese version only)

-

Poster - Scameter+

-

Poster - Pretend Customer Service Impersonation Scam

Relevant information:

- Pretend Telecommunications Service Providers

- Impersonate Customer Service Staff of WeChat -

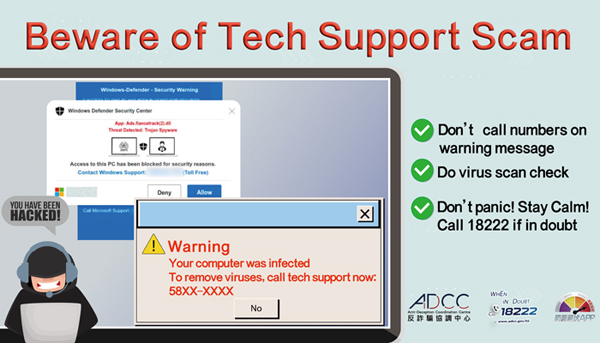

Poster - Tech Support Scam

Relevant information:

Impersonate Tech Support -

Useful Links

- CyberDefender

- Anti-Deception Coordination Centre

- Hong Kong Monetary Authority – Fraudulent Bank Websites, Phishing Emails and Similar Scams

- Securities And Futures Commission – Alert List

- Hong Kong Police Force

- Office of the Government Chief Information Officer (OGCIO)

- Hong Kong Computer Emergency Response Team Coordination Centre (HKCERT)

- Government Computer Emergency Response Team Hong Kong (GovCERT.HK)

- InfoSec

- Investor and Financial Education Council (IFEC)

- Cyber Security Information Portal

- Cybersechub.hk

- Family Conflict and Sexual Violence Policy Unit (FCSV)

- The Hongkong Federation of Youth Group - Youth Crime Prevention Centre

- eHelp Association

- HKIRC - Cybersec Training Hub

- PasswordManager.com

-

Presentation deck

-

-

News and Activities

-

- Reaching Out to the Community - Privacy Commissioner Attends the Dinner Reception of Zonta Club of Kowloon and Shares Anti-fraud Tips

- Reaching Out to University - PCPD’s Representative Shares Fraud Prevention Tips with Students of the Hong Kong Baptist University

- Seminar on “Protecting Personal Data to Prevent Fraud”

- Raising Public Awareness of Fraud Prevention – Privacy Commissioner’s Office Launches a New Anti-fraud Promotional Poster

- Reaching Out to University – Privacy Commissioner Shares Fraud Prevention Tips with Lingnan University Students

- Reaching Out to the Community – Privacy Commissioner Interviewed by the Media to Remind the Public Beware of Scams

- Fraud Enquiries Soar by Over 40% Privacy Commissioner’s Office Offers Six Tips to Prevent Fraud

- Sharing Festive Joy with Smart Elders – Privacy Commissioner’s Office Volunteer Team Organises a Fraud Prevention Christmas Gathering for Around 200 Elders

- Promoting Anti-fraud Messages in Education Sector – Privacy Commissioner Gives Keynote Speech at the “Launch Ceremony of Anti-deception Alliance (Education) 2024”

- Anti-Scam Lucky Draw

- Spreading Love in the Festive Season – Privacy Commissioner’s Office Volunteer Team Visits the Elderly

- Raising Public Awareness to Combat Fraud – PCPD’s Representative Attends Anti-fraud Promotional Event

- Reaching Out to the Community – Privacy Commissioner Interviewed by the Media on the Latest Trend of Deepfake Fraud Cases

- Reaching Out to the Community – Privacy Commissioner Interviewed by the Media to Remind the Public to Stay Vigilant Against Fraud

- Privacy Commissioner’s Office Offers Six Tips to Prevent Fraud The Privacy Commissioner Demonstrates Deepfake Face Swapping

- Seminar on “Beware of Scams Protect Your Personal Data”

- Raising Public Awareness of Fraud Prevention – Privacy Commissioner’s Office Launches a New Episode of Anti-fraud Promotional Video

- “Don’t Hand Over Your Personal Data – Beware of Fraudsters” – Privacy Commissioner’s Office Volunteer Team Organises a Christmas Talk for the Elderly

- Raising Public Awareness to Combat Fraud – Privacy Commissioner’s Office Organises a Seminar on “Safe Use of WhatsApp and Social Media Platforms”

- Privacy Commissioner’s Office Urges the Public and Organisations to Guard against WhatsApp Account Hijacking

- Raising Public Awareness of Fraud Prevention – Privacy Commissioner’s Office Launches New Anti-fraud Promotional Video

- Privacy Commissioner’s Office Launches Anti-fraud Promotional Campaign Entitled “Don’t Hand Over Your Personal Data – Beware of Fraudsters”

- Privacy Commissioner’s Office Urges the Public to Guard against Phishing Websites and Fraudulent SMS Messages

- As the Year of the Rabbit Approaches, Privacy Commissioner Reminds the Public to Guard against Fraud

- Be a Smart Elderly — Privacy Commissioner’s Office Volunteer Team Organises a New Year Talk for Elderlies

- Contributing to the Community – Privacy Commissioner’s Office Volunteer Team Distributes Anti-Fraud Posters and Medical Supplies to Social Welfare Organisations

- Privacy Commissioner Publishes “Hong Kong Letter” – Stay Vigilant to Prevent Personal Data Fraud

- Privacy Commissioner’s Office Sets up Fraud Prevention Hotline 3423 6611 Public Urged to Guard Against Personal Data Fraud

-

-

Seek Assistance

-

- Personal Data Fraud Prevention Hotline: 3423 6611

- “Anti-Scam Helpline 18222” Hotline, the Anti-Deception Coordination Centre of the Hong Kong Police Force

If you suspect that you or your family members have fallen prey to a scam, please dial 999 for assistance. For details, please visit: Hong Kong Police Website – Contact Us

-